Evaluating Local Authority Credit in a New Era of Budgetary Constraints

UK local authorities have historically enjoyed a strong credit profile. The few that are rated are mostly in the AA category and none have ever defaulted.

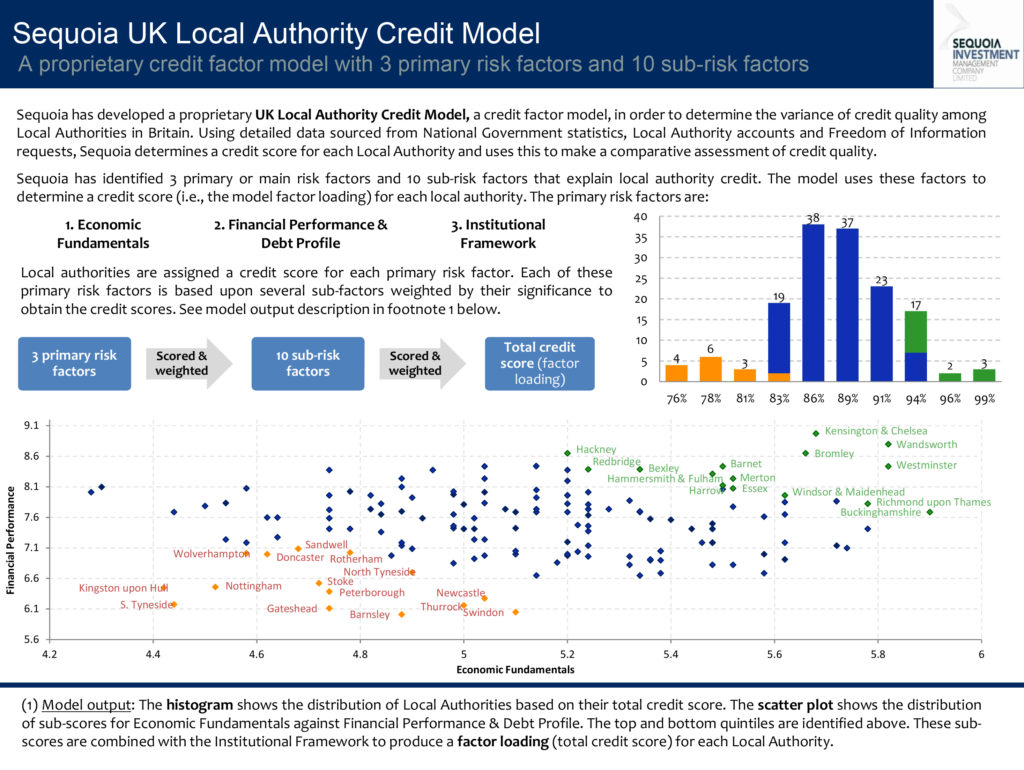

SIMCo’s proprietary UK Local Authority credit factor model

UK local authorities have historically enjoyed a strong credit profile. The few that are rated are mostly in the AA category and none have ever defaulted.

However, the framework for local authorities is changing and their budgets will be under continuing pressure for many years to come. We have built a proprietary credit factor model to assess UK local authority credit strength. This assists us when selecting assets dependant on unitary availability payments from local authority governments. We use the same framework for assessing local government credit in countries outside the UK.

Default is not the only driver of credit risk

The lesson from many countries such as Spain, the US and Italy is that it is important for creditors to understand the drivers of local government credit risk, which can manifest itself not just through payment default, but also payment delays or difficult renegotiations of historic deals that were entered into in more economically benign times. This includes states, counties, local authorities and other municipalities.

In the UK, SIMCo has a specific focus on local authorities, as they are the primary source of revenues for many PPP/PFI projects (especially schools), through unitary payments. Deterioration in their financial profile could, therefore, be a credit negative for these transactions. Our analysis is designed to assess this risk.

SIMCo’s proprietary UK Local Authority Credit Model

SIMCo has developed a proprietary Local Authority Credit Model (a credit factor model for the UK) in order to determine the credit quality among local authorities in Britain. Using detailed data sourced from National Government statistics, local authority accounts and Freedom of Information requests, SIMCo determines a credit score (the model factor loading) for each local authority.

The model contains three primary risk factors and 10 sub-risk factors in order to determine a credit score for each Local Authority. The main risk factors are:

- Economic Fundamentals

- Financial Performance and Debt Profile

- Institutional Framework

Local authorities are assigned individual scores for each main risk factor. Each of these main risk factors is based upon several sub-risk factors weighted by their degree of importance to obtain model factor loadings.

SIMCo Credit Rating

SIMCo uses its Local Authority Credit Model to make data-driven judgments on the comparative credit quality of local authorities. It creates a rigorous and factor-analytic framework to assist in our relative credit analysis. The local authority credit assessment is only one of many factors SIMCo considers when assigning the SIMCo Credit Rating to an individual infrastructure debt transaction. In many cases, other risks may be more important such as the credit quality of other transaction counterparties, the financial gearing of the project and other project-specific considerations.

The model permits SIMCo to monitor structural shifts in the overall financial strength of UK local authorities as a group and over time will permit us to build a time-sequence database of evolving local authority resilience. SIMCo also uses its Local Authority Credit Model to help in the investment selection process and to determine the appropriate concentration limits (i.e., maximum exposure) to local authorities whose debt is included in one or more of our infrastructure debt portfolios. The Local Authority Credit Model will be used as part of our ongoing monitoring procedure under which SIMCo’s ratings on individual UK loans are monitored and reviewed.